WI Wells Fargo Form POA 2021-2026 free printable template

Show details

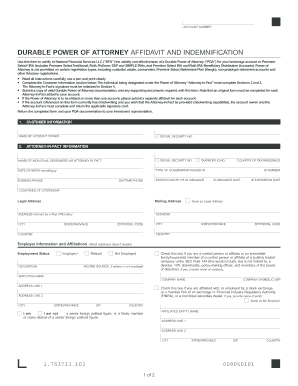

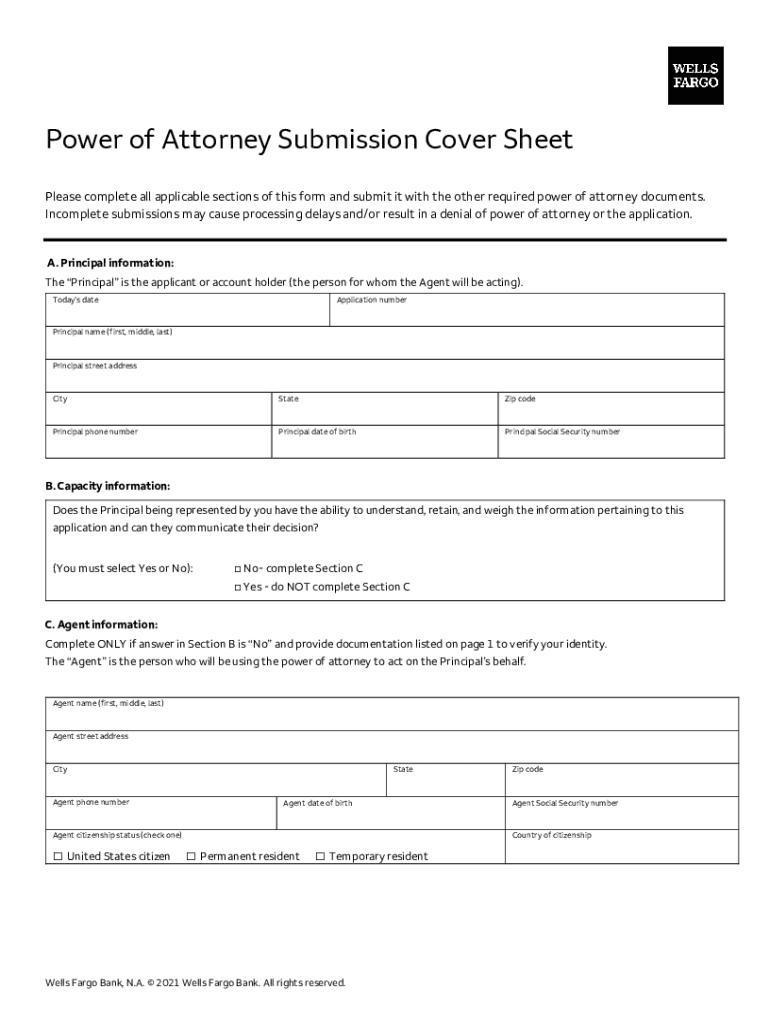

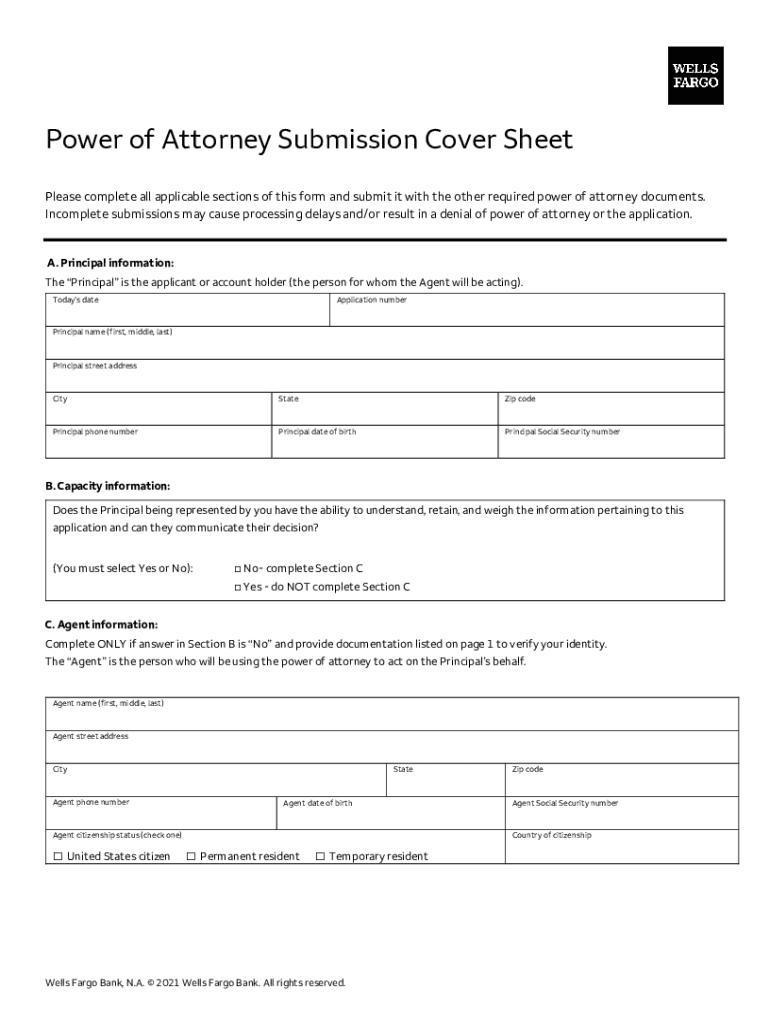

This document outlines the necessary steps and requirements for submitting a power of attorney in relation to a personal loan, including required documentation, identity verification instructions, and contact information for submissions and inquiries.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign wells fargo power of attorney form

Edit your wells fargo power of attorney form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wells fargo poa form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit to add a poa to a wells fargo account the previously prepared and executed elsewhere form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI Wells Fargo Form POA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out power of attorney wells fargo form

How to fill out power of attorney packet

01

Gather the required documents: Collect the power of attorney form, identification, and any necessary supporting documents.

02

Choose your agent: Select a trusted individual who will act on your behalf.

03

Fill out the form: Complete the power of attorney form with the required information, including your name, agent's name, and the powers you wish to grant.

04

Specify the powers: Clearly outline the financial, medical, or legal powers you are granting to your agent.

05

Sign the document: Sign the power of attorney form in the presence of a notary public or witnesses as required by your state.

06

Distribute copies: Provide copies of the signed document to your agent, relevant institutions, and keep one for your records.

Who needs power of attorney packet?

01

Individuals who want to ensure their financial and medical decisions are managed when they are unable to do so themselves.

02

People who are planning for future incapacity due to illness or absence.

03

Those needing assistance in handling specific legal or financial matters, even if temporarily.

Fill

wells fargo bank power of attorney form

: Try Risk Free

People Also Ask about wells fargo poa requirements

Can you add a beneficiary to an individual account?

Clients can designate beneficiaries for both individual retirement accounts (IRAs) and brokerage accounts. However, the process for updating your beneficiaries differs between the two, so make sure you follow the correct steps for the type of account you have.

How do I set up a beneficiary for my checking account?

Simply go into your bank branch and ask that another name be put onto the account. Make sure that person is with you, because they will have to sign all the paperwork.

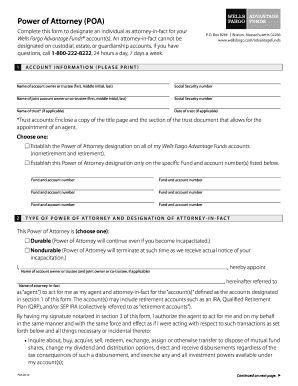

How do I add a power of attorney to my Wells Fargo account?

To add a POA to a Wells Fargo account, the account holder may either sign the Wells Fargo Power of Attorney form (only applies to Wells Fargo Mortgage and Home Equity accounts) or present Wells Fargo with a power of attorney previously prepared and executed elsewhere.

Can I add a beneficiary to my Wells Fargo account?

Wells Fargo has made it easy to designate a beneficiary for your checking account. Your beneficiary will be able to access the funds in your account after you die. You can complete the Wells Fargo Checking Beneficiary Form online or in person at a Wells Fargo banking center.

Can I add a beneficiary to my account online?

Most financial will require you to contact your local branch or call customer service to add a beneficiary. However, some may also let you make changes to your account through online banking. Bank account beneficiaries may be added at any time.

Can I add someone to my Wells Fargo mortgage?

If you have an existing assumable mortgage, you may be able to add or remove borrower(s) through an assumption loan.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit wells fargo power of attorney submission cover sheet in Chrome?

how to fill out power 06 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the to add a poa to previously prepared and executed elsewhere in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your wisconsin wells fargo power poa and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete wells fargo power of attorney requirements on an Android device?

Use the pdfFiller Android app to finish your wells fargo power of attorney for bank account and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is power of attorney packet?

A power of attorney packet is a set of legal documents that grants a person the authority to act on behalf of another in legal or financial matters.

Who is required to file power of attorney packet?

Individuals who wish to delegate their legal authority to someone else, such as agents or attorneys-in-fact, are required to file a power of attorney packet.

How to fill out power of attorney packet?

To fill out a power of attorney packet, one must provide their personal information, the details of the agent, specify the powers being granted, and sign the document in accordance with state laws.

What is the purpose of power of attorney packet?

The purpose of a power of attorney packet is to legally authorize someone to make decisions or take actions on behalf of another person in specified matters.

What information must be reported on power of attorney packet?

The information that must be reported includes the principal's details, agent's details, the scope of powers being granted, and any limitations or special instructions.

Fill out your WI Wells Fargo Form POA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wells Fargo Attorney Poa is not the form you're looking for?Search for another form here.

Keywords relevant to clients can designate beneficiaries for beneficiary to my account online

Related to power of attorney form kansas

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.